With the demand in markets like Japan expected to rise, the wood pellets industry has much room for sustainable development, which can be boosted by increasing the proportion of Forest Stewardship Council (FSC)-certified products.

Statistics from the Ministry of Agriculture and Rural Development show that in 2019 there were about 80 wood pellet factories in the country. However, other sources claim that there might be up to 300 pellet processing establishments, far more than the official statistics.

According to these sources, in Vietnam’s southeastern region alone, where wood processing facilities are concentrated, the number of pellet producers had reached about 200. The main reason for this strong concentration would be that wood by-products from other processing facilities are brought in as input material to produce pellets.

Such input sources include sawdust, shavings, twigs, and tops of planted wood with a diameter of about two centimetres or less. The pellet producers do not require large and complex investments in management technology, which enables them to easily participate in the production.

In addition, Vietnam has a geographical advantage when it comes to these raw materials as exports seaports are nearby, enabling convenient transportation.

The demand for wood pellets is forecast to expand three times by 2024-2025 compared to today. However, a significant supply-demand imbalance, together with issues in quality and legal conditions, affect large-scale exporters and the sustainable development of the pellet industry. Up to now, most of the involved enterprises act rather spontaneous, without much institutional support to regulate the development of the industry.

Therefore, there are several limitations within the industry. Firstly, input materials lack quality control, and some processing facilities use mixed materials, affecting the end product’s quality.

The input supply with FSC certified wood is also limited, while the export markets demand these certified products increasingly. There have also been some indications of fraud when it comes to FSC-certified products, with more claims than the actual supply. Even if these indicators turn out to be false, such information harms the industry.

Next, the industry is faced with greater supply than demand, leading to fierce competition among businesses and including unfair aspects such as price manipulation. While many enterprises are involved in processing, only a few exporters exist. With this current situation, the industry remains unsustainable at large.

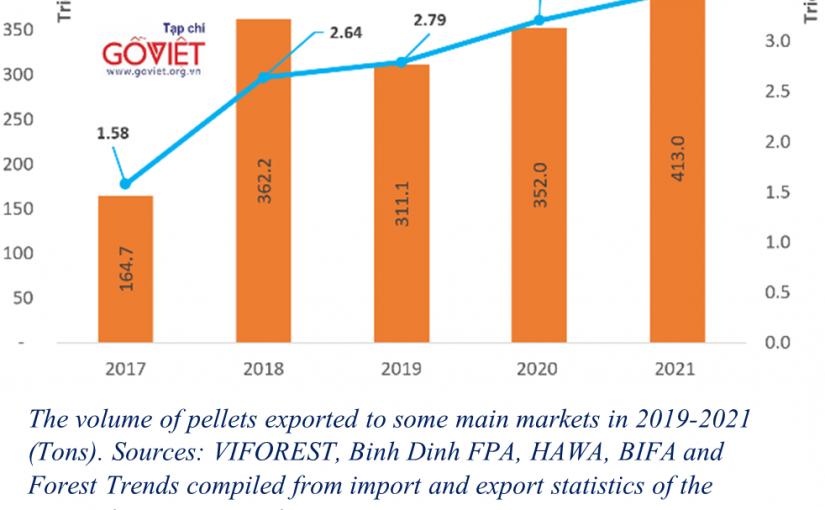

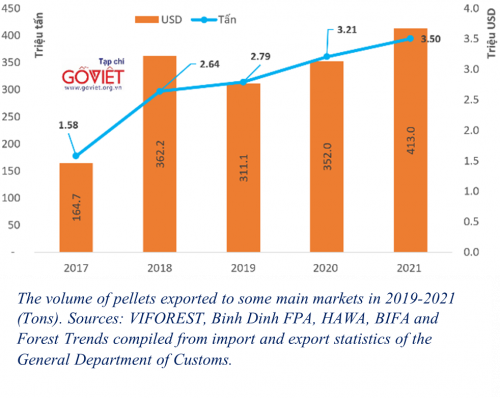

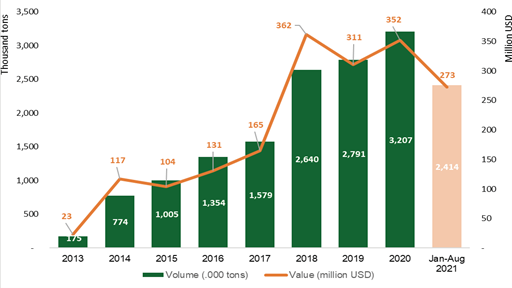

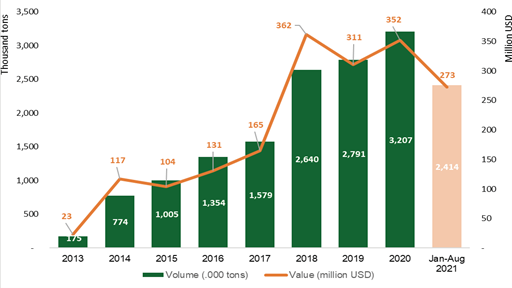

Nevertheless, wood pellets are an important export item of Vietnam. In recent years, around three million tonnes, equivalent to $350 million, had been exported. South Korea and Japan are the most important markets of Vietnam, with the volume of these two markets accounting for over 90 per cent of the total annual export volume.

In the first eight months of 2021, the export volume reached 2.4 million tonnes, equivalent to $273 million in turnover. In general, exports are on a growth track and increased sharply in the 2018-2020 period.

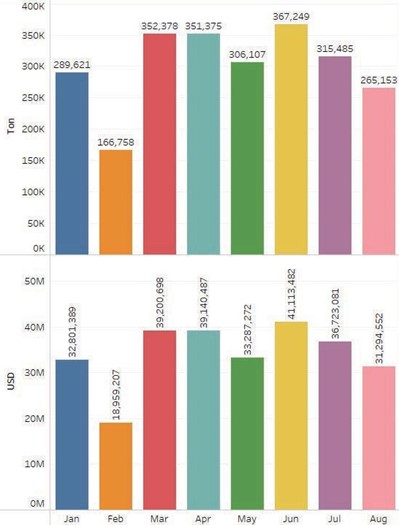

The pandemic has had an impact on all socioeconomic aspects, especially on production and exports. Like other industries, Vietnam’s wood pellet industry has also been negatively impacted, with exports and volumes falling sharply in recent months.

Markets by volume and value

Between South Korea and Japan, the former is larger than the latter. However, the level of stability in the Japanese market is higher, as South Korea contains some uncertainties.

Like the export volume, the export turnover from the Japanese market is smaller than that of South Korea but has greater stability. The South Korean market had a very strong decline in 2019 and since then there has been no sign of growth again. The average export price to the Japanese market is currently higher than the one to South Korea, about $20-30 per tonne on average.

Information from some exporters shows that the current low export price to the South Korean market comes as this market applies an auction mechanism when buying products, with businesses offering low prices.

After receiving these contracts, the businesses return to manufacturers in Vietnam and push product prices down to meet the contracts they have signed with buyers.

Meanwhile, the purchasing mechanism in the Japanese market does not follow the auction model but depends directly on the agreements between buyers and sellers and consequently does not push down prices.

Enterprises by market and size

Statistical data on the export of wood pellets shows that on average, over 70 enterprises are involved in exporting each year. The number of businesses participating in this stage has not changed much, at least between 2019 and 2020. However, this went down in the first eight months of 2021 to only 59, much smaller than in 2020 and likely due to the pandemic.

The number of exporting enterprises to South Korea was much larger than those exporting to Japan, which corresponds to the volume of exports to these two markets.

The average export price per unit to Japan is always higher than to South Korea. This may cause exporters to move from the South Korean market to the Japanese market, or at least try to enter both markets. However, businesses participating in both markets at the same time are rare. For example, in 2020 only 10 enterprises were participating in both markets, but it remains unclear why.

One of the main characteristics of exporters is that there is a great deal of differentiation, with a small number of very large export companies and many smaller companies.

In that year, there were six very large enterprises, equivalent to 8 per cent of the total number of exporters. These six exported about 1.96 million tonnes of wood pellets, accounting for 61 per cent of total exports. In the same year, 40 enterprises accounting for 54 per cent of the total had a very small export volume, with less than 10,000 tonnes per company and a export share of a mere 2 per cent.

In the next 2-3 years, if Vietnam’s production capacity is kept at the current level, the supply and demand for wood pellets will be balanced. However, to do so, it is necessary to form an organisation representing the industry because this would directly contribute to the regulation of production and export activities. Such an organisation would take the role of connecting manufacturing and exporting enterprises and regulating output market.

The organisation could then act as a focal point, providing members with information on the output markets, including on-demand and legal and sustainable requirements. Moreover, the organisation could convey recommendations to management agencies to form policy mechanisms close to reality, promoting the sustainable development of the industry in Vietnam.

UK Pellet Council chair, Mark Lebus, said the organisation is working with overseas partners to help ensure a continuous supply of biomass wood pellets for UK customers, as wood pellets will no longer be sourced from Russia or imported from Russian producers.

UK Pellet Council chair, Mark Lebus, said the organisation is working with overseas partners to help ensure a continuous supply of biomass wood pellets for UK customers, as wood pellets will no longer be sourced from Russia or imported from Russian producers.